The digital divide at the heart of financial inclusion

New digital currencies create the potential for a more inclusive and equitable global financial system. However, the decision to impose overly strict regulatory and compliance standards could instead lead to fragmented systems that would only reinforce the digital divide and tragedy of the unbanked. As policy makers formulate regulatory requirements and processes for these new technologies, they have an opportunity to construct a regulatory bar that does not put compliance requirements and serving the unbanked at odds with each other.

A key area of focus for compliance is “Know Your Customer” (KYC) regulations, the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 (“AML/CFT Act”) and the need to respect sanctions. While we recognize that these standards serve legitimate needs, defaulting to the most restrictive standards risks pushing more activity into the informal sector. Instead, its imperative that new payment infrastructures take into account the nuances of the realities we see in our work with refugees, small farmers and other vulnerable populations around the world.

There is an opportunity to create a safe, ethical pathway for those financially excluded at present to be included in these new digital economies. Having a more inclusive and innovative approach to KYC and AML/CFT compliance is at the root of the success for mobile money platforms, such as M-Pesa in Kenya. New platforms must consider carefully how to approach this problem to avoid reinforcing the precedent of systematically excluding the vulnerable populations that are already “unbanked” in the first place.

Understanding the unbanked

For people living in fragile and insecure markets, access to financial products can mean the difference between poverty and prosperity. People today are excluded for various reasons including a lack of reliable identification, proximity to conflict and terrorist organizations, underdeveloped financial services infrastructure, unstable governments and poor macroeconomic policy environments.

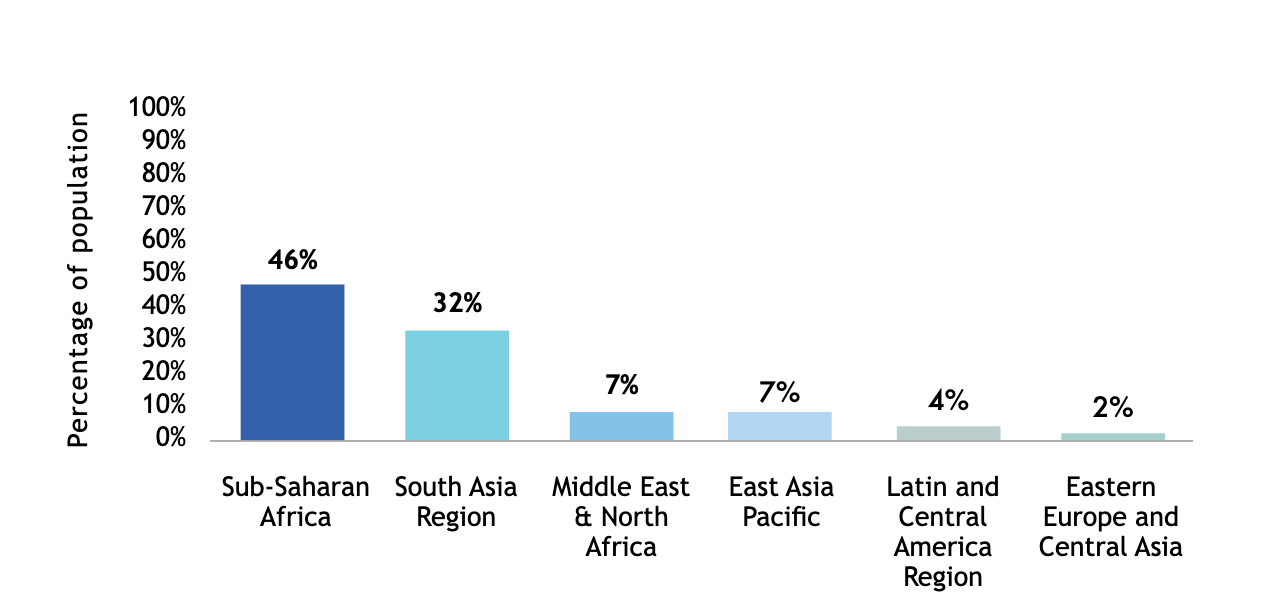

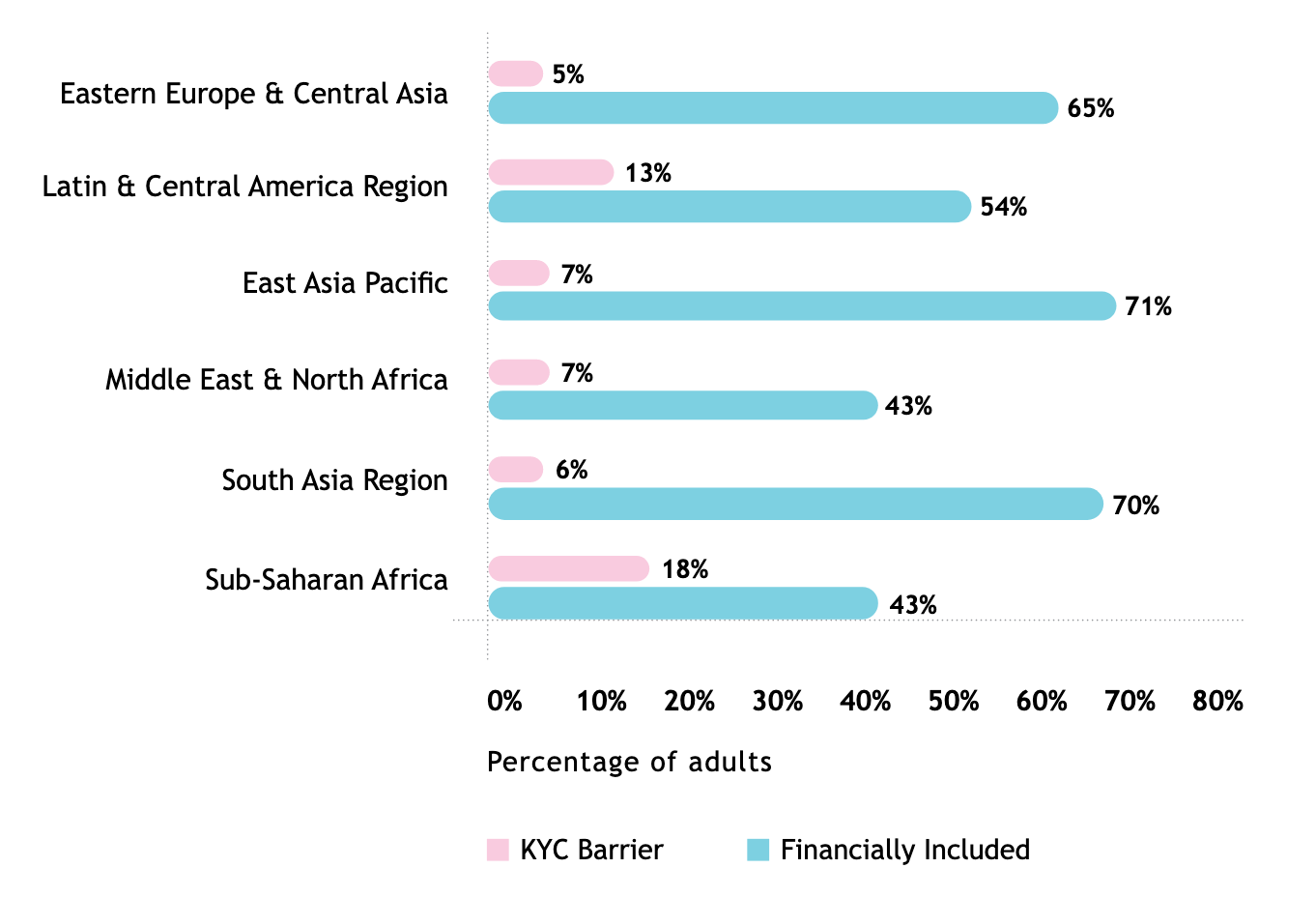

Over 1.1 billion people do not have government-issued IDs. Of course, not everyone who lacks an official identity document is a bad actor, and not everyone who lacks an identity has a clear path to getting one. The ID gap is one of the key reasons overly restrictive KYC requirements present a significant barrier to inclusion. People lack government issued IDs for a variety of reasons, first and foremost because of government capacity failures. Other significant groups lacking official identity documentation include refugees, populations displaced by natural disasters, conflict, or threat of persecution.

For most banks, the risks and costs of servicing the very poor and marginalized is too high. The costs include managing geographically remote operations for very small account holders and the risks revolve around the requirements of KYC and AML/CFT compliance. This has contributed to the massive sea of of over 2.5 billion people that don’t have access to financial services, limiting their ability to build assets and secure their financial futures. With existing platforms, over 1.7 billion people cannot even get access to a bank account. Digital payment via mobile phones dramatically increases the ability to extend financial services to people in remote locations and to those who have only very small accounts.

We need both VASPs and unhosted wallets

The Financial Action Task Force (FATF) recognizes the need for virtual asset service providers (VASPs) as well as unhosted wallets in a virtual currency ecosystem. While unhosted wallets given people direct access to their virtual currency through hardware devices or software, VASPs maintain a customer’s virtual currency balance on the internet and generally also provides storage and transaction security and are regulated as such. In an increasingly mobile banking world, VASPs will likely provide the commonly-used onramps and offramps for the economy; providing the critical infrastructure needed to build an ecosystem and help people move between the digital currency and the local fiat currency. VASPs would need to be licensed and carry out traditional KYC and AML/CFT checks much like their predecessors, including traditional banks and financial institutions. However, VASPs alone are not enough.

The KYC/AML requirements of the VASPs would largely block off the potential inclusion of the 1.7+ billion who are already unbanked, creating simply a new digital version of the exclusive system we have now. Unhosted wallets could help solve this problem by catering to refugees, small-holder farmers and other vulnerable populations around the world by facilitating smaller transaction amounts and account balances; activities consistent with the financial reality in many of the places where we work.

Unhosted wallets could also help address another problem we often see: Lack of reliable internet connectivity. Many people in developing countries live in remote areas without reliable access to the internet (or even electricity, in some places). Unhosted wallets can function in these challenging environments, and can support peer-to-peer transactions in even the most basic situations. The ability to handle those without government I.D.s and to function in low/no internet environments are two of the key reasons why unhosted wallets are in alignment with meaningful financial inclusion.

Blockchain-based systems offer new approaches to address the requirements of AML/CFT compliance that can bring transactions safely into the system rather than forcing them out. The following are key reasons why a network of both unhosted wallets and VASPs is required to meaningfully serve the needs of the unbanked by addressing key barriers to access:

- Including people without access to IDs. According to the World Bank, 1.1 billion people live without access to any form of identification and are therefore typically systematically excluded from accessing regulated financial services. People without official IDs often live in rural areas; in countries in which government institutions are unable or unwilling to issue official identity documents to all residents; or cannot afford to procure identities. Yet, many of these same people have cell phones capable of handling cryptocurrency transactions.

- Reducing the number of people that are systemically excluded. According to UNHCR, there are 70.8 million forcibly displaced persons today, 43 million of these are internally displaced persons (IDPs), people who are displaced and without a home but living, often in camps, in their home country. IDPs are often targeted for religious or ethnic reasons. Many of these IDPs, often the most vulnerable, lack addresses or identification and are often excluded from financial services and at great risk when carrying cash. Many also have cell phones, regularly communicate with relatives around the world and rely on access to the internet for survival, but are unable to receive remittances. Many of the people currently systematically excluded, particularly IDPs, will remain so unless unhosted wallets are allowed. Until custodial, registered VASPs are able to provide services, something we hope to see with continued innovation, unhosted wallets could serve the needs of many of the world’s forcibly displaced, allowing them to preserve what wealth they have in the face of conflict and displacement. For IDPs, this could allow them to remain in their country of origin instead of fleeing to a new country.

- Reducing reliance on informal cash transfer networks. Today, many people in high risk environments rely exclusively on informal cash transfer networks to access the international economy and remittances. Governments are forced to allow informal cash transfer networks to operate despite the risks. This is currently true, for example, in Somalia. Although we hope that VASPs will find innovative ways to serve populations in these higher risk environments, we anticipate that the risk reward trade-offs will prevent them from doing so. Today, despite efforts from governments around the world to encourage more reasonable levels of risk taking, banks are de-risking entire populations and regions. Unhosted wallets would provide a pathway to including these populations in the formal global economy, reducing reliance on informal cash transfer networks and providing much greater transparency on value flows into and around high risk environments.

- Providing a store of value for the unconnected. Unhosted wallets also offer the opportunity for people living beyond the reach of the internet or that do not have the means to regularly access the internet to store value in devices not connected to the internet, something that is particularly valuable for, women, refugees, and people living in remote settings.

Managing unhosted wallet risks

Blockchain-based systems with VASPs and unhosted wallet transactions on one platform is far more suitable for enhancing detection and mitigation of bad actors than the status quo of untraceable cash-based informal transactions. This is because blockchains can provide the unique ability to distinguish between transactions involving exchanges, VASPs, and unhosted wallets and require that VASPs and exchanges confirm compliance with the “travel rule” on chain. Such a system would provide a much lower risk profile than the system of money transfer and payment networks operating today. Further, all transactions involving unhosted wallets would be easily monitored for any signs of illicit activity; today’s cash environment provides no comparable capability.

Different governments will no doubt take different approaches to unhosted wallets in this new world of digital currencies. They will decide how to regulate VASPs and unhosted wallets based on their policy priorities. In any event, because a transaction involves a registered VASP and is visible on the underlying blockchain, governments will be able to easily monitor registered VASPs for compliance with their local jurisdiction’s rules regarding transactions with unhosted solutions.

Often overlooked is the fact that unhosted wallets do not need to be completely pseudonymous. The setup of an unhosted wallet could, for example, include simplified user registration (e.g., simply a phone number and a name or perhaps even a selfie). Combined with limits on transactions and balances and real-time fraud detection, these systems raise significantly the barriers for a bad actors and are significantly less prone to abuse than our current cash economy.

There has also been a general acknowledgement across major economies that disproportionate de-risking increases overall AML/CFT risk rather than mitigates it. So regulators across the world have an opportunity to respond to the risks and opportunities of new technologies by setting new precedents for how to achieve compliance and improve financial services infrastructure for those most in need. Policymakers, entrepreneurs and innovators can leverage blockchain, VASPs, unhosted wallets to bridge the gaps in ethical and responsible ways.

Why we care

Mercy Corps is one of the leading global experts working to facilitate functioning markets and systemic change in fragile and insecure contexts. Based on our experiences on the ground and in light of the technological advancements being rolled out now, Mercy Corps sees multiple converging technological advances as potentially transformative for the most challenging environments in the near term: expanding access to digital networks; providing digital financial services tailored to vulnerable communities; and creating value-added services that help drive inclusion. We feel blockchain and cryptocurrencies can provide game-changing tools to realize that potential.

Mercy Corps understands how quickly and powerfully access to digital technology can change the life of the most vulnerable populations. We continue to lead global thought and action on cash as the most efficient means of providing aid. Mercy Corps envisions a world where a cash distribution — whether traditional or with cryptocurrencies coupled with smart contracts — becomes the first step for an unbanked person to build a transaction history that allows increasing levels of access to financial services like index-based disaster insurance, crop insurance, remittances, loans, and much more.

The challenges of financial inclusion are tremendous and the gaps are massive. We know that the ability to achieve digital financial inclusion relies on data-driven research as much as on innovation and new technology to level the playing field. Moving forward, it is critical to support for real-time, independent research and sound advice regarding digital currencies’ positive and negative social impact as well as funding mechanisms for distributing and managing grants that drive social impact.

Summary

- The most significant decision for policy makers and leaders is whether to risk systematically excluding whole swathes of the population from new digital currency systems or to actively create a safe, ethical pathway for their inclusion.

- Compliance has to be balanced with the risks of financial exclusion and a rapid increase in inequality of access that pushes more activity into the informal sector.

- Besides the cost of transactions, the largest barrier to inclusion is overly restrictive KYC requirements that ignore over 1.1 billion+ people who do not have the required government-issued ID.

- A blockchain-based ecosystem of VASPs and unhosted wallets can help create a standard for pre-KYC eligibility that is agreed upon and brings transactions safely into the system rather than forcing them out.