Why we invested: Meridia

Grit — anyone looking to innovate in the land formalisation space needs this trait in spades. We know this well from Mercy Corps’ extensive land and conflict programming in Latin America and Sub Saharan Africa, not to mention our 2017 investment in Suyo. Our decision to invest in Meridia ultimately came down to the grit of co-founders Simon Ulvund and Thomas Vaassen. Meridia is an end-to-end solution for land and property documentation for individuals and communities in frontier markets, where accurate maps and effective land administration systems do not often exist.

For us, the issue of land rights is a fundamental one and crosses between our focuses on agriculture and frontier fintech. Land rights (or property rights) also occupies a unique place on the global development agenda: Either you are fanatically passionate about the issue, or you’ve never heard of it. But whether you know it or not, land rights and their resulting conflicts touch upon many of the sectors and countries that development agencies, like Mercy Corps, focus on.

The scale of land insecurity is daunting; approximately 72 per cent of the world’s population — more than 4 billion people — live on physical property for which they do not hold formal rights or documentation. In many countries, people have little if any protection for their land, and are vulnerable to the risk of land disputes, fraud and evictions. In fact, in many countries, landlessness is the best predictor of poverty. So property rights represent the key institutional asset on which people could build their livelihoods. (If you’re interested to learn more about this issue and some exciting new developments in the space, check out our NextBillion article.)

You might already know that 75% of startups in Silicon Valley fail. This is a market where the conditions are perfect for success — nearly unlimited capital, a deep talent pool, business-friendly regulations, and a customer base with the ability to pay. Conversely, ventures like Meridia and Suyo are tackling a massive challenge with numerous critical government touch points, a highly complex service delivery model and customers with a limited ability to pay. On top of that, the capital market for startups in their ecosystems is thin and fragmented.

That said, the market potential is massive (billions of people), the willingness to pay is validated, the customer value proposition real, and emerging technologies are simultaneously continually demystifying and decreasing the cost of the formalisation process. If Suyo and/or Meridia can crack it, they are poised to grow exponentially and create unparalleled impact.

I first sat down with Thomas Vaassen , CTO and co-founder of Meridia (then called Landmapp), at a small cafe in Jakarta back in 2015. Fresh off their success in helping to scale Impact Hub, Thomas and his co-founder Simon had set their sights on one of the most interesting, albeit hairy, challenges one could find. Still in the pilot phase, Thomas painted a grand picture of tech startup that would leverage emerging geospatial technology and crowdsourcing to unlock land tenure and associated services for millions of farmers. I was impressed by the team’s vision, tech and humility — but I thought that they had a long road ahead of them in understanding the complexity of the market and service. We passed. But I remained very intrigued and a Meridia cheerleader from afar — keeping in touch and connecting when our travel paths aligned.

Flash forward to late-2018, Mercy Corps Ventures was well into the second year of its investment in Suyo. We were in the process of finalising the Catalytic Land Financing Facility with Omidyar Network. Mercy Corps globally was taking a deeper look at its history of land rights and access work, and thinking critically about how to scale it. Then Omidyar Network, a co-investor in Suyo, arranged for me to sit down to meet Thomas and Simon on the sidelines of their board meeting. We spent a morning together, chatting about their progress, challenges, and the path forward. I departed that meeting certain that this was a deal Mercy Corps Ventures should do.

One thing that really stood from that meeting was the grit of both founders. Time and time again, Meridia had hit hurdles in scaling their original model. But they kept persevering. The team was uncovering key validation factors, building a solid Ghanaian team, developing stellar field-tested tech, and pivoting accordingly. Anyone looking to innovate in the land formalisation space needs grit in spades. Simon Ulvund and Thomas Vaassen have it.

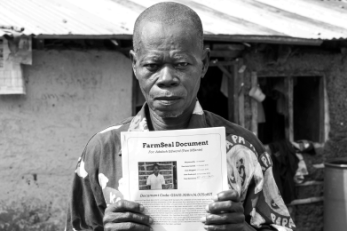

By the time we spoke that day, Meridia had successfully delivered >10,000 land documents to smallholder farmers at an affordable price, providing both peace of mind and access to a host of benefits / services. Most of this was via direct to consumer sales (B2C) with some sort of installment payment plan. While viable, this would require significant capital for financing the installment plan, relatively high customer acquisition costs and slower growth.

The major “ah-ha” moment for me as an investor came as they described an emerging partnership with a world leading agribusiness. Meridia’s prospective agribusiness customer was struggling to understand who its farmer partners were (geospatial & identity data) and what they were producing. Simultaneously, they were interested to channel services to farmers that are 1) uniquely impactful, 2) highly valued by farmers, and 3) helps the company secure more product both in terms of quantity and quality.

Meridia is well positioned at the confluence of a few major trends in agribusiness. Government regulators and consumers are demanding more supply chain transparency, while agribusinesses simultaneously are competing to more directly engage, train and retain smallholder farmers as partners, suppliers and customers. Moreover, in tree crops like cocoa, palm and tea, smallholders’ productivity is declining as the trees age. Coupled with climate change, agribusinesses are grappling with an existential crisis in their supply chains: limited projected supply and lower quality.

Without tailored extension services and in some cases a complete replanting programme, we could be facing massive issues in these crops. Mapping and land tenure underpins all of this. Agribusinesses need valid data on who is producing what and where in order to increase engagement with their farmer suppliers / customers. As well, without land tenure, farmers have little incentive or ability to take on the massive financial risk and disruption to engage in a replanting programme.

Meridia’s land mapping and documentation services are able to deliver major value to agribusinesses and smallholders on all these fronts. Moreover, they are building an incredibly rich, valid and ground truthed agricultural dataset of 10,000’s of land parcels that could be groundbreaking when coupled with emerging remote sensing and precision agriculture technology.

Since our investment, Meridia has inked contracts and pilots with a number of the world’s largest agribusinesses to map 10,000’s of parcels and deliver thousands of land documents in 2019.

It can’t be understated — each one of these documents provides critical peace of mind to smallholders, as well as unlocks services that can drastically improve their livelihoods. The confluence of Meridia’s breadth (potentially 100,000s of farmers), depth (>60% increase in production and 150% increase in income), and reach of impact (true BoP smallholder farmers) is compelling. These pilots in the cocoa, oil palm, coffee and tea value chains could transform property rights and documentation service delivery to smallholders.

"We’ve known Mercy Corps Ventures for a long time and it means a lot to us that they have now stepped in. Mercy Corps as a whole brings a deep understanding of smallholder agriculture to the table, while the team at Mercy Corps Ventures is already showing its tremendous value in areas such as financing, market entry and value chain analysis. We are pleased to have them on board as we start scaling our business."

- Thomas Vaassen, Co-Founder of Meridia

Meridia is at an inflection point, and we are excited to be part of that journey.